Department of Labor shall conduct an audit and if they find any violence in minimum wages which is section 206, 207, and 255 by the employers; the department of labor shall proceed with section 29 U.S. § 216 (b) towards signing the consent by the plaintiffs and then they shall allow going to the court for filing the class action to enforce the law with the judiciary.

The attorneys of the department of labor shall file a summons and complaints under section 29 U.S. § 216 (b) to the federal court and then the federal judge will enforce the sections 29 U.S. § 216 (b).

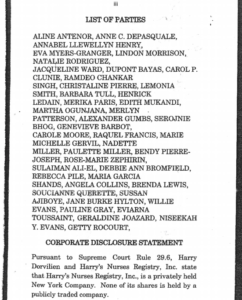

Gayle v. Harry’s Nurses Registry Inc: according to the labor law, all cases need to have consent from the department of labor for 29 U.S.C. § 216 (b). Gayle v. Harry’s Nurses Registry Inc. case did not have consent before the case was filed.

For instance, three other cases ‘Crouch v. Guardian Angel Nursing, Inc., (Nov. 4, 2009)’, ‘Wilson v. Guardian Angel Nursing, Inc., (July 31, 2008)’, ‘Lemaster v. Alternative Healthcare Solutions, Inc.’ had consent before the case has filed and also jurisdictions, however, ‘Gayle v. Harry’s Nurses Registry, Inc.’ case doesn’t have any of it.

Executive Summary: On September 17, 2013, the U.S. Department of Labor (DOL) issued its long-delayed Final Rule revising its regulations to eliminate the Fair Labor Standards Act’s (FLSA) companionship exemption for agency-employed direct care workers. While the effective date of the revisions is postponed until January 1, 2015, home care agencies will be exposed to significant wage and hour liability they never had before.

What Has Changed?

Reversing a decades-long interpretation, the DOL’s Final Rule states: “(t)he new regulatory text precludes third party employers (e.g. home care agencies) from claiming the (companionship) exemption for companionship services or live-in domestic service employees.” Thus, under the new regulation, all agency-employed direct care workers who are currently considered exempt will be protected by the FLSA’s minimum wage, overtime, and record-keeping requirements.

What Effect Will the Changes Have?

The Rule exposes home care agencies to significant wage and hour liability in each of the following areas:

- overtime for all hours over 40 in a workweek at time and one-half a worker’s regular rate (the regular rate includes hourly differential pay that will increase the rate on which overtime is calculated);

- wages at a worker’s regular rate for additional hours claimed on 24-hour cases;

- wages for travel time between cases or to training and medical exams;

- wages for calls to work during “duty-free” time;

- wages for in-service training time; and

- wages for required annual medical exam time.

Although the DOL’s Final Rule did not change its position on “hours worked” by non-exempt employees during travel time, sleep time, meal periods, or on-call, its comments interpret how these provisions will be applied to agency-employed direct care workers. For example:

Sleep Time: Currently, “where an employee is required to be on duty for 24 hours or more, the employer and employee may agree to exclude a bona fide meal period or a bona fide regularly scheduled sleeping period of not more than eight hours…[if] adequate sleeping facilities are furnished by the employer, and … the employee’s time spent sleeping is usually uninterrupted.” Regarding agency-employed direct care workers who may not have been subject to this rule under the companionship exemption, the DOL “believes that sufficient time exists before the effective date of [the] Final Rule for the employer and employee to enter into an agreement…” Further, “while the employer may not terminate an employee for refusing to enter into an agreement… the employer would not be required to agree to a continuation of the same terms and conditions of employment.” Thus, if the direct care worker will not sign an agreement, the agency may assign the worker only to shifts of less than 24 hours

Meal Periods: Currently, “[b]onafide meal periods are periods where the employee is completely relieved from duty for the purposes of eating a regular meal.” Thus, a direct care worker “is not relieved from duty if he or she is eating with the consumer and is required to feed or otherwise assist that individual with eating.”

Off-Duty Time: Currently, “if an employee is completely relieved from duty and is free to use the time effectively for his or her own purposes, such time periods are not hours worked.” Thus, a direct care worker “who is required to remain on call on the employer’s premises or so close thereto that he or she cannot use the time effectively for his or her own purposes is working while on call and must be compensated for such time.”

Rest and Waiting Periods: Currently, if an employee is on-premises and could be summoned to work at any moment, this is compensable time, unless excluded under the bona fide meal, sleep period or off-duty rules. Thus, a direct care worker who takes a rest period of short duration, running from 5 to 20 minutes, must be paid for this time.

Travel Time: Currently, “travel time from job site to job site during the workday must be counted as hours worked.” Further, “[t]hough Medicaid may not provide reimbursement for the time that an employee spends traveling between clients, nothing in the Medicaid law prevents a third party employer from paying for that time.” Thus, a direct care worker who travels to more than one worksite for the employer during the workday must be paid for the travel time spent between each worksite.

Overtime Costs: In the DOL’s opinion, “continuity of care does not necessarily require a single direct care worker, but rather can involve a small group of direct care workers intimately familiar with the consumer and his or her needs.” The DOL reasons that “[a]ssuming at least two direct care workers are currently used to provide 24-hour care, 7 days per week, adding a third direct care worker may allow effective management of overtime while introducing relatively little disruption to continuity of care.” The DOL adds: “[m]odifying work patterns to increase the number of direct care workers… does not preclude the industry from offering consumers the option to pay a higher rate in return for fewer direct care workers.”

The Bottom Line: One thing is certain: the new costs imposed on home care agencies will challenge their ability to administer and operate their agencies and stay in business. Perhaps the most revealing comment by the DOL in the Final Rule is its statement that “the primary effect (of projected transfers, costs and net benefits of revisions to the FLSA regulations)… is the transfer of income from home care agencies… to direct care workers.”

If you have any questions regarding this Alert, please contact the author, Stephen Zweig, Partner in FordHarrison’s New York City office, who has counseled and defended home care agencies for over 30 years, at szweig@fordharrison.com