Attorney General, 2848 consent to bring the co officer personally under rule 12(a)3 and the disclosure form under 26 U.S.C. 6103(i)(1)

DISCLOSURE UNDER 26 U.S.C. 6103(i)(1)

Section 6103(i)(1) of Title 26 authorizes application for an ex parte order for the disclosure of “any return or return information to officers or employees of any federal agency who are personally and directly engaged in” the investigation, or preparation for prosecution, of violations of specifically designated federal criminal statutes other than ones involving tax administration. The application must explain the intended use.

Applications for the ex parte order authorized by this paragraph may be authorized by: the Attorney General, the Deputy Attorney General, the Associate Attorney General, any Assistant Attorney General, a United States Attorney, any special prosecutor appointed under 28 U.S.C. § 593, or any attorney in charge of a Criminal Division organized crime strike force established pursuant to 28 U.S.C. § 510. It is anticipated that most applications will be authorized by United States Attorneys or Strike Force Chiefs. See the list of forms in this Manual at 514.

Prior to the submission of this application, however, the responsible official should notify the appropriate IRS District Director that such action is being planned. This notice should include all relevant details so that IRS can:

Assemble the requested information; and

Make any appropriate determination provided for in 26 U.S.C. § 6103(i)(6), (see this Manual at 511 regarding confidential informants and impairment of investigations).

Applications may be submitted to either federal magistrate judges or federal district court judges. Applicants must demonstrate that:

There is reasonable cause to believe that a specific federal crime has occurred;

There is reasonable cause to believe that the tax information sought is relevant to the offenses;

The information will be used exclusively in a federal criminal investigation or proceeding concerning such act (except as provided in 26 U.S.C. § 6103(i)(4), see this Manual at 509; and

The information cannot reasonably be obtained from another source.

Language in the application and order should track the statutory language as closely as possible. Because 26 U.S.C. § 6103(i)(1) refers to disclosure for the “enforcement of a specifically designated federal criminal statute,” applicants should list every statutory violation for which “reasonable cause” exists.

Applicants should file simultaneously with the application a motion requesting the court to seal the application and its order granting or denying the application. United States Attorneys should notify the Internal Revenue Service whenever a motion to seal is granted, and whenever the records are subsequently unsealed. Such motions are normally not necessary when an applicant determines (in consultation with IRS if appropriate) that disclosure of the application will not jeopardize an ongoing investigation.

As noted in this Manual at 605, 26 U.S.C. § 6103(i)(1) applications now cover return information other than taxpayer return information (as well as all return and taxpayer return information). Therefore, when such an application has been made, it is not necessary to make a separate 26 U.S.C. § 6103(i)(2) request for return information other than taxpayer return information.

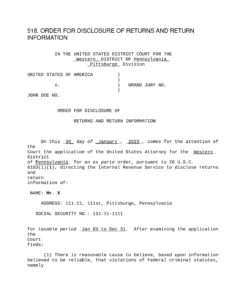

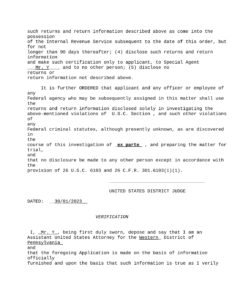

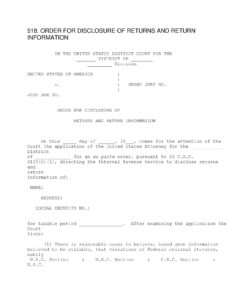

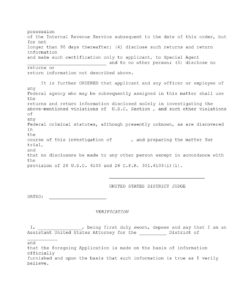

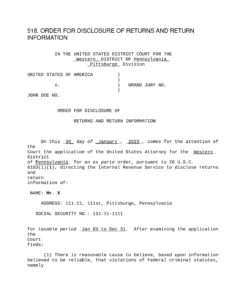

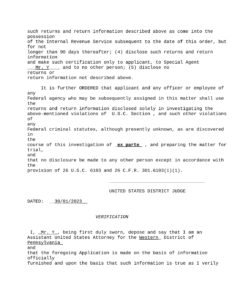

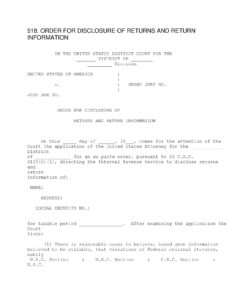

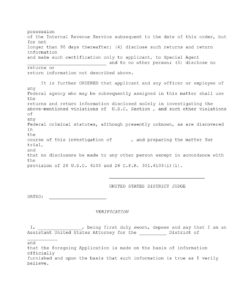

Sample form is: https://www.justice.gov/archives/jm/criminal-resource-manual-518-order-disclosure-returns-and-return-information

A sample form is attached here-