In the labor-related lawsuit, Amastal et al v. Pasta Resources Inc. et al, private attorney Mr. Jonathan Bernstein filed multiple cases against the employer without adhering to federal or state labor laws. Specifically, Mr. Bernstein’s lawsuit did not comply with several key statutes, including the Fair Labor Standards Act of 1938, the Portal-to-Portal Act, and the Employee Retirement Income Security Act.

Before filing any labor lawsuit, an audit conducted by the Department of Labor (DOL) must first identify violations of sections 29 U.S.C. 206, 207, and 255. These violations would then necessitate the enforcement of 29 U.S.C. 216(b) through the Department of Justice. However, in the Amastal et al v. Pasta Resources Inc. et al case, this criterion was not met. Mr. Bernstein bypassed the Department of Labor, filing the lawsuit without establishing any violations of 29 U.S.C. 206, 207, and 255. Furthermore, Mr. Bernstein is implicated in the misinterpretation and misrepresentation of numerous other lawsuits, behavior that could be characterized as a scheme.

Batali complaint Southern District NY:

Batali proof of service SDNY

Pasta Resources inc Proof of Service SDNY

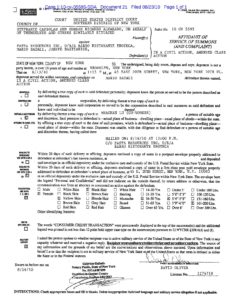

Proof of Service

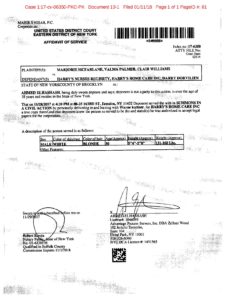

Summons and Proof of Service McFarlane

Read the Law

2456.29 U.S.C. 201 To 219: The Fair LABOR STANDARDS ACT is a Department of Justice code enforcement that can only be used by the federal government and the U.S. Department of Labor.

The case: 10 Civ. 5595 (RJH), Stephanie capsules, et al, Plaintiffs against Pasta Resources, Inc., et al., ( Defendants) is a scam because they brought this suit pursuant to the Fair Labor Standard Act, 29 U.S.C. § 201 et seq ( “FLSA”) but this is ( Stephanie vs Pasta Resources ) an enforcement code by the department of justice and can only use by the U.S department of labor after the violations 28 U.S.C § 206 and 207 under the fair labor standard act.

An article on the case written by Villanueva & Sanchala is as follows :

https://www.new-york-employment-lawyer-blog.com/restaurant-owners-beware-skimm/

MARCH 10, 2012

FLSA Lawyer News Update: New York Restaurant Settles Overtime Lawsuit for $5M

By Villanueva & Sanchala

Celebrity chef Mario Batali and his chief business partner Joe Bastianich have reached a $5.25 million settlement with workers who had alleged violations of New York Labor Law and the FLSA. The lawsuit, filed in July 2010, alleged that Batali and his partner had a standard policy of taking 4-5% of the tip pool that was given to servers for alcohol and wine sales.

The lawsuit was initially brought by a waitress who worked at Batali’s restaurant, Babbo, in the Village. The workers’ allegations included charges of unpaid overtime wages, unpaid minimum wages, unpaid spread of hours pay, and unpaid misappropriated tips. Our attorneys have represented and helped many restaurant workers who have not been paid their rightful compensation. If you are a waiter, waitress, bartender or any type of tipped worker and have been denied any of your rightful wages or tips or are a restaurant owner unfairly accused, call our attorneys to help you.

The amended complaint charged that Batali and Bastianich “unlawfully confiscated a portion of their workers’ hard-earned tips in order to supplement their own profit. At the end of every shift, instead of distributing customers’ credit card tips to the workers who earned them as the law requires, Mr. Batali, Mr. Bastianich, and their restaurant took from the tip pool an amount equal to approximately 4-5% of the restaurants’ wine sales (and sometimes other beverage sales) for the night and put it in their own pockets.”

The class action included 117 workers. However, the settlement agreement could cover about 1,100 current and former workers at 8 Italian style New York restaurants. Some of the restaurants named in the lawsuit include Babbo, Del Posto, Casa Mono, Bar Jamon, Esca, Lupa, and Otto.

Each plaintiff will receive a part of the settlement monies depending on how many hours he or she worked at the restaurants. It will be available to the restaurants’ captains, servers, waiters, bussers, runners, back waiters, bartenders, and/or barbacks who worked there from July 22, 2004, to February 14, 2012, and who do not opt out of the settlement.

If you are a tipped employee such as a waiter, waitress, waiter, bartender, or valet, your combined cash and tip minimum wage rate must total $7.25 per hour. If you do not earn at least $7.25 including tips in any given hour of work, your employer must make up this difference. New York law also provides that if you are a restaurant worker whose workday is longer than ten hours, you must receive an extra hour of pay at the basic minimum hourly rate of $7.25 in addition to the pay for the actual hours you worked. If you are a tipped employee working at a restaurant, your employer cannot make you share your tips with non-service employees who do not in the ordinary course of business regularly receive tips. These are just a few things to keep in mind if you are working in the food service industry. If you think your employer is not accurately paying you your required wages, forcing you to share your tips in violation of New York Labor law or the FLSA, or taking a part of your gratuities, call our Wage & Hour Attorneys at Villanueva & Sanchala at (800) 893-9645 to discuss how we can help you protect your rights to your compensation.

Disclaimer: Thank you for visiting our Blog. This blog provides general information and thoughts about various employment law issues primarily in the New York Tri-State area and occasionally in other areas. You are welcome to read the posts. However, do not construe any content on this blog as legal advice or the creation of an attorney-client relationship. Again, we provide the content only for informational purposes. You should not make decisions based on information on our blog since the application of the law depends on the facts and each situation may be different. In addition, the law in most jurisdictions is different and changes constantly and we make no representations that any information on our blog has been updated. The Blog should not be used as a substitute for competent legal advice from an experienced employment law attorney in your state or jurisdiction.