BROOKLYN SAV. BANK v. O’NEIL is a lawsuit that has been reversed by the supreme court in 1945. It’s the right time for Mr. Hary Dorvilier to get justice and reversed the bad law that misinterpreted in the lawsuit against himself and his corporation Harry’s Nurses Registry Inc.

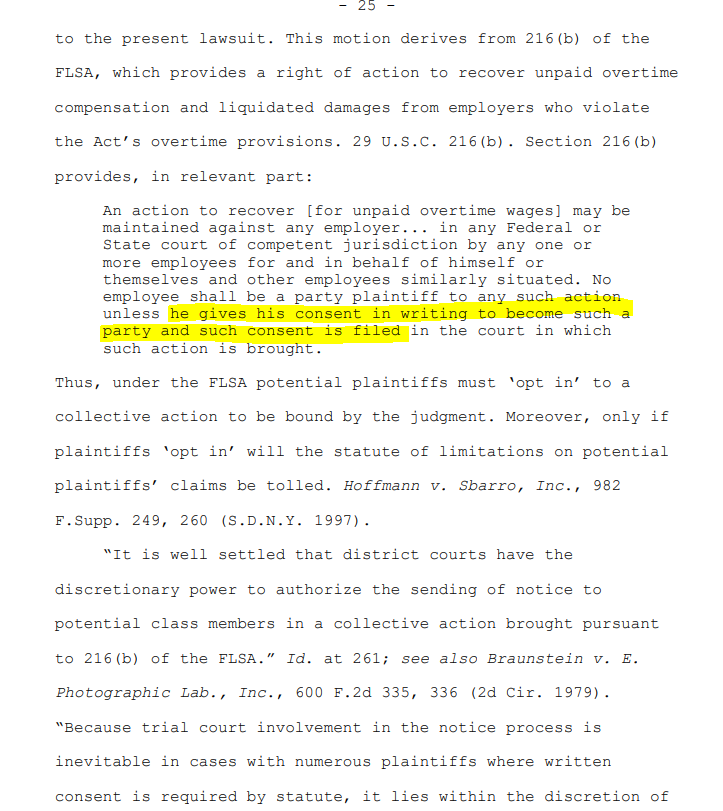

According to section 29 U.S.C.A 216 (a), (b) and (c), and prior to starting the lawsuit, consent shall be given in writing. and this consent shall be signed after the audit has been completed by the department of labor. Judge and Jonathon Bernstine have violated Harry’s Nurses Registry Inc and Harry Dorvilier’s 14 amendments by not following the due process of law.

The Federal Employers Liability Act (FELA), codified at 45 U.S.C.S. § 51-60

The Jones Act 46 USCS Appx section 688 (2002)

GARRETT v. MOORE-McCORMACK CO., Inc., et al.

Merchant Seamen Protection and Relief

Duncan v. Thompson, 315 U.S. 1

Pacific Mail SS Co. v. Lucas, 258 U.S. 266

Arrow Stevedore Co. v. Pillsbury, 88 F.2d 446 (9th Cir. 1937)

Pacific Employers Ins. Co. v. Pillsbury, 9 Cir., 130 F.2d 21

Henderson v. Glens Falls Indemnity Co., 5 Cir., 134 F.2d 320

Anthony Marcella, Appellant, v. United States of America, Appellee, 285 F.2d 322 (9th Cir. 1961)

THE CONCLUSION OF THE CASE:

Plaintiff’s motion for partial summary judgment on the issue of liability is granted, and the defendants’ motion for summary judgment is denied. In addition, the plaintiff’s motion seeking leave to circulate a notice of pendency pursuant to 29 U.S.C. § 216(b) is granted. Defendants are directed to disclose the names, last known addresses, dates of employment, and telephone numbers for all persons employed as field or per diem nurses from November 7, 2004, to the present on or before April 9, 2009. Plaintiff is directed to settle a proposed Notice of Pendency and consent form on or before the same date.

SO ORDERED.

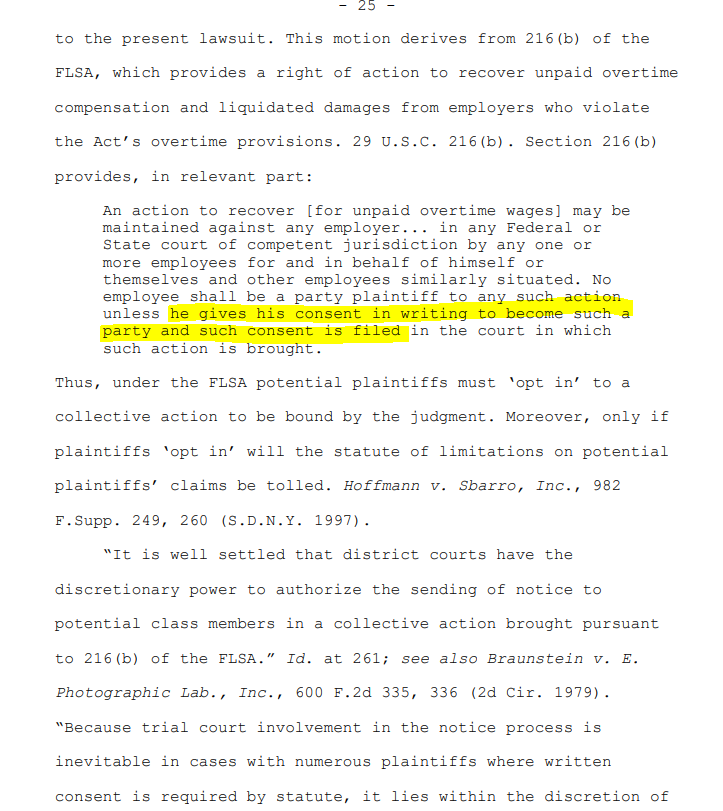

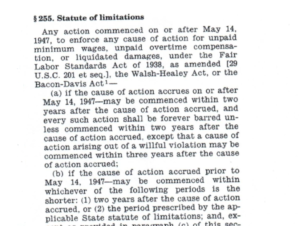

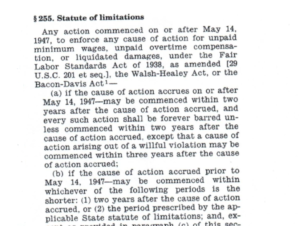

According to 29 U.S.C. § 216:

(a) Fines and imprisonment

Any person who willfully violates any of the provisions of section 215 of this title shall upon conviction thereof be subject to a fine of not more than $10,000, or to imprisonment for not more than six months, or both. No person shall be imprisoned under this subsection except for an offense committed after the conviction of such person for a prior offense under this subsection.

(b) Damages; right of action; attorney’s fees and costs; termination of right of action

Any employer who violates the provisions of section 206 or section 207 of this title shall be liable to the employee or employees affected in the amount of their unpaid minimum wages, or their unpaid overtime compensation, as the case may be, and in an additional equal amount as liquidated damages. Any employer who violates the provisions of section 215(a)(3) of this title shall be liable for such legal or equitable relief as may be appropriate to effectuate the purposes of section 215(a)(3) of this title, including without limitation employment, reinstatement, promotion, and the payment of wages lost and an additional equal amount as liquidated damages. Any employer who violates section 203(m)(2)(B) of this title shall be liable to the employee or employees affected in the amount of the sum of any tip credit taken by the employer and all such tips unlawfully kept by the employer, and in an additional equal amount as liquidated damages. An action to recover the liability prescribed in the preceding sentences may be maintained against any employer (including a public agency) in any Federal or State court of competent jurisdiction by any one or more employees for and in behalf of himself or themselves and other employees similarly situated. No employee shall be a party plaintiff to any such action unless he gives his consent in writing to become such a party and such consent is filed in the court in which such action is brought. The court in such action shall, in addition to any judgment awarded to the plaintiff or plaintiffs, allow a reasonable attorney’s fee to be paid by the defendant, and costs of the action. The right provided by this subsection to bring an action by or on behalf of any employee, and the right of any employee to become a party plaintiff to any such action, shall terminate upon the filing of a complaint by the Secretary of Labor in an action under section 217 of this title in which (1) restraint is sought of any further delay in the payment of unpaid minimum wages, or the amount of unpaid overtime compensation, as the case may be, owing to such employee under section 206 or section 207 of this title by an employer liable therefor under the provisions of this subsection or (2) legal or equitable relief is sought as a result of alleged violations of section 215(a)(3) of this title.

In conclusion, Judiciary shall not order employers to disclose the employee’s name, address, and so forth. Department of labor must do an audit and all plaintiffs shall consent before the case filed.

Gayle v. Harry’s Nurses Registry Inc: All cases never had consent by plaintiffs and audits haven’t done by the department of labor for 29 U.S.C. $ 216 (b). The audit has to been conducted by the Department of labor for Harry’s Nurses Registry. And plaintiffs never signed consent before case filled. Defendant also did not violate the provisions of section 206 or section 207. It is the sole responsibility of the department of labor about the violation of sections 206 and 207.

Therefore, This case has misinterpreted.

Gayle v. Harry’s Nurses Registry Inc.

Rule 26.1 Corporate Disclosure Statement

Appeal decision by Judge Sifton

Gayle v. Harry’s Nurses Registry, Inc. et al (1:07-cv-04672-NGG-PK)