Fact and Enforcement Procedures Under 29 U.S.C. 216 (b) to the Federal Judge and Department of Justice

<h2 “style=”text-align: left;”> 1. LIABILITY: The Liability of IRS and the DOL is governed by the Federal Tort Claims Act[28 U.S.C.§ 1346(b), 2672, et seq.], or other application federal statutory authority

* 28 U.S. Code § 1346 – United States as defendant

(a)The district courts shall have original jurisdiction, concurrent with the United States Court of Federal Claims, of:

(1) Any civil action against the United States for the recovery of any internal-revenue tax alleged to have been erroneously or illegally assessed or collected, or any penalty claimed to have been collected without authority or any sum alleged to have been excessive or in any manner wrongfully collected under the internal- revenue laws;

(2) Any other civil action or claim against the United States, not exceeding $10,000 in amount, founded either upon the Constitution, or any Act of Congress, or any regulation of an executive department, or upon any express or implied contract with the United States, or for liquidated or unliquidated damages in cases not sounding in tort, except that the district courts shall not have jurisdiction of any civil action or claim against the United States founded upon any express or implied contract with the United States or for liquidated or unliquidated damages in cases not sounding in tort which are subject to sections 7104(b)(1) and 7107(a)(1) of title 41. For the purpose of this paragraph, an express or implied contract with the Army and Air Force Exchange Service, Navy Exchanges, Marine Corps Exchanges, Coast Guard Exchanges, or Exchange Councils of the National Aeronautics and Space Administration shall be considered an express or implied contract with the United States.

(b)

(1) Subject to the provisions of chapter 171 of this title, the district courts, together with the United States District Court for the District of the Canal Zone and the District Court of the Virgin Islands, shall have exclusive jurisdiction of civil actions on claims against the United States, for money damages, accruing on and after January 1, 1945, for injury or loss of property, or personal injury or death caused by the negligent or wrongful act or omission of any employee of the Government while acting within the scope of his office or employment, under circumstances where the United States, if a private person, would be liable to the claimant in accordance with the law of the place where the act or omission occurred.

(2) No person convicted of a felony who is incarcerated while awaiting sentencing or while serving a sentence may bring a civil action against the United States or an agency, officer, or employee of the Government, for mental or emotional injury suffered while in custody without a prior showing of physical injury or the commission of a sexual act (as defined in section 2246 of title 18).

(c) The jurisdiction conferred by this section includes jurisdiction of any set-off, counterclaim, or other claim or demand whatever on the part of the United States against any plaintiff commencing an action under this section.

(d) The district courts shall not have jurisdiction under this section of any civil action or claim for a pension.

(e) The district courts shall have original jurisdiction of any civil action against the United States provided in section 6226, 6228(a), 7426, or 7428 (in the case of the United States district court for the District of Columbia) or section 7429 of the Internal Revenue Code of 1986.

(f) The district courts shall have exclusive original jurisdiction of civil actions under section 2409a to quiet title to an estate or interest in real property in which an interest is claimed by the United States.

(g) Subject to the provisions of chapter 179, the district courts of the United States shall have exclusive jurisdiction over any civil action commenced under section 453(2) of title 3, by a covered employee under chapter 5 of such title.

28 U.S. Code § 2672 – Administrative adjustment of claims

The head of each Federal agency or his designee, in accordance with regulations prescribed by the Attorney General, may consider, ascertain, adjust, determine, compromise, and settle any claim for money damages against the United States for injury or loss of property or personal injury or death caused by the negligent or wrongful act or omission of any employee of the agency while acting within the scope of his office or employment, under circumstances where the United States, if a private person, would be liable to the claimant in accordance with the law of the place where the act or omission occurred: Provided, That any award, compromise, or settlement in excess of $25,000 shall be effected only with the prior written approval of the Attorney General or his designee. Notwithstanding the proviso contained in the preceding sentence, any award, compromise, or settlement may be effected without the prior written approval of the Attorney General or his or her designee, to the extent that the Attorney General delegates to the head of the agency the authority to make such award, compromise, or settlement. Such delegations may not exceed the authority delegated by the Attorney General to the United States attorneys to settle claims for money damages against the United States. Each Federal agency may use arbitration, or other alternative means of dispute resolution under the provisions of subchapter IV of chapter 5 of title 5, to settle any tort claim against the United States, to the extent of the agency’s authority to award, compromise, or settle such claim without the prior written approval of the Attorney General or his or her designee.

Subject to the provisions of this title relating to civil actions on tort claims against the United States, any such award, compromise, settlement, or determination shall be final and conclusive on all officers of the Government, except when procured by means of fraud.

Any award, compromise, or settlement in an amount of $2,500 or less made pursuant to this section shall be paid by the head of the Federal agency concerned out of appropriations available to that agency. Payment of any award, compromise, or settlement in an amount in excess of $2,500 made pursuant to this section or made by the Attorney General in any amount pursuant to section 2677 of this title shall be paid in a manner similar to judgments and compromises in like causes and appropriations or funds available for the payment of such judgments and compromises are hereby made available for the payment of awards, compromises, or settlements under this chapter.

The acceptance by the claimant of any such award, compromise, or settlement shall be final and conclusive on the claimant and shall constitute a complete release of any claim against the United States and against the employee of the government whose act or omission gave rise to the claim, by reason of the same subject matter.

29 U.S. Code § 216b – Liability for overtime work performed prior to July 20, 1949

No employer shall be subject to any liability or punishment under the Fair Labor Standards Act of 1938, as amended [29 U.S.C. 201 et seq.] (in any action or proceeding commenced prior to or on or after January 24, 1950), on account of the failure of said employer to pay an employee compensation for any period of overtime work performed prior to July 20, 1949, if the compensation paid prior to July 20, 1949, for such work was at least equal to the compensation which would have been payable for such work had section 7(d)(6) and (7) and section 7(g) of the Fair Labor Standards Act of 1938, as amended [29 U.S.C. 207(d)(6), (7), (g)], been in effect at the time of such payment.(Oct. 26, 1949, ch. 736, § 16(e), 63 Stat. 920.)

<h2 “style=”text-align: left;”> 2. Liability: Fact and Enforcement Procedures Under 29 U.S.C. 211 (b)

29 U.S. Code § 211 – Collection of data

(a)Investigations and inspections

The Administrator or his designated representatives may investigate and gather data regarding the wages, hours, and other conditions and practices of employment in any industry subject to this chapter, and may enter and inspect such places and such records (and make such transcriptions thereof), question such employees, and investigate such facts, conditions, practices, or matters as he may deem necessary or appropriate to determine whether any person has violated any provision of this chapter, or which may aid in the enforcement of the provisions of this chapter. Except as provided in section 212 of this title and in subsection (b) of this section, the Administrator shall utilize the bureaus and divisions of the Department of Labor for all the investigations and inspections necessary under this section. Except as provided in section 212 of this title, the Administrator shall bring all actions under section 217 of this title to restrain violations of this chapter.

(b)State and local agencies and employees

With the consent and cooperation of State agencies charged with the administration of State labor laws, the Administrator and the Secretary of Labor may, for the purpose of carrying out their respective functions and duties under this chapter, utilize the services of State and local agencies and their employees and, notwithstanding any other provision of law, may reimburse such State and local agencies and their employees for services rendered for such purposes.

(c)Records

Every employer subject to any provision of this chapter or of any order issued under this chapter shall make, keep, and preserve such records of the persons employed by him and of the wages, hours, and other conditions and practices of employment maintained by him, and shall preserve such records for such periods of time, and shall make such reports therefrom to the Administrator as he shall prescribe by regulation or order as necessary or appropriate for the enforcement of the provisions of this chapter or the regulations or orders thereunder. The employer of an employee who performs substitute work described in section 207(p)(3) of this title may not be required under this subsection to keep a record of the hours of the substitute work.

(d)Homework regulations

The Administrator is authorized to make such regulations and orders regulating, restricting, or prohibiting industrial homework as are necessary or appropriate to prevent the circumvention or evasion of and to safeguard the minimum wage rate prescribed in this chapter, and all existing regulations or orders of the Administrator relating to industrial homework are continued in full force and effect.

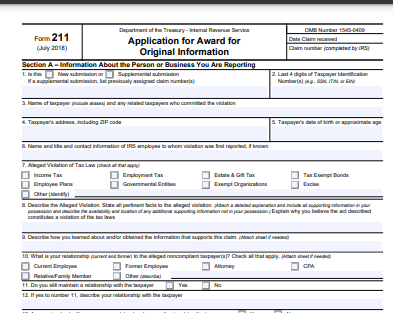

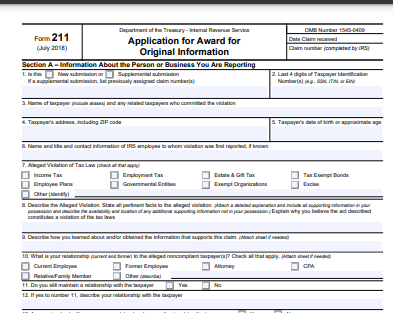

Privacy Act and Paperwork Reduction Act Notice

IRS ask for the information on this 211 form to carry out the internal revenue laws of the United States. Its authority to ask for this information is 26 USC 6109 and 7623. It is collected this information for use in determining the correct amount of any award payable to you under 26 USC 7623. It may disclose this information as authorized by 26 USC 6103, including to the subject taxpayer(s) as needed in a tax compliance investigation and to the Department of Justice for civil and criminal litigation. You are not required to apply for an award. However, if you apply for an award you must provide as much of the requested information as possible. Failure to provide information may delay or prevent processing your request for an award; providing false information may subject you to penalties.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. Generally, tax returns and return information are confidential, as required by 26 U.S.C. 6103.

The time needed to complete this form will vary depending on individual circumstances. The estimated average time is 45 minutes. If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can email us at *taxforms@irs.gov (please type “Forms Comment” on the subject line) or write to the Internal Revenue Service, Tax Forms Coordinating Committee, SE: W: CAR: MP: T: T: SP, 1111 Constitution Ave. NW, IR-6406, Washington, DC 20224.

Send the completed Form 211 to the above Ogden address of the Whistleblower Office. Do NOT send the Form 211 to the Tax Forms Coordinating Committee.

29 U.S.C 211(b). NYSDOL is responsible for enforcement of the labor law of the state of New York through the administration of a variety of programs, including Worker Protection, and the Federal-State Unemployment insurance program

Aggrement Between The U.S. Department of Labor, Wages and Hour Division and New York State Department of Labor…Details of “State Unemployment insurance program<“

Partnership Agreement Between The U.S. Department of Labor, Wage and Hour Division and Labor Bureau of the New York State Office of Attorney General

3. Fact and Enforcement Procedures Under 29 U.S.C. 211 (b) WORKERS’ COMPENSATION

MEMORANDUM OF UNDERSTANDING (MOU) AGREEMENT BETWEEN THE U.S. DEPARTMENT OF LABOR Wage and Hour Division, The U.S Department of Labor Occupational Safety and Health Administration, and THE NEW YORK WORKERS’ COMPENSATION BOARD

4. 29 U.S.C. § 252 – U.S. Code – Unannotated Title 29. Labor § 252. Relief from certain existing claims under the Fair Labor Standards Act of 1938, as amended, the Walsh-Healey Act, and the Bacon-Davis Act </h2

No court of the United States, of any State, Territory, or possession of the United States, or of the District of Columbia, shall have jurisdiction of any action or proceeding, whether instituted prior to or on or after May 14, 1947, to enforce liability or impose punishment for or on account of the failure of the employer to pay minimum wages or overtime compensation under the Fair Labor Standards Act of 1938, as amended [29 U.S.C.A. § 201 et seq.], under the Walsh-Healey Act, or under the Bacon-Davis Act, to the extent that such action or proceeding seeks to enforce any liability or impose any punishment with respect to an activity which was not compensable under subsections (a) and (b) of this section.

No court of the United States, of any State, Territory, or possession of the United States, or of the District of Columbia, shall have jurisdiction of any action Deatils here..

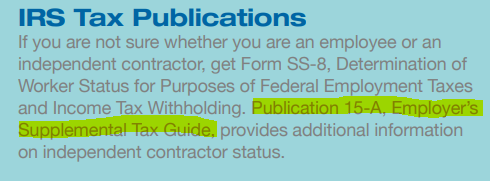

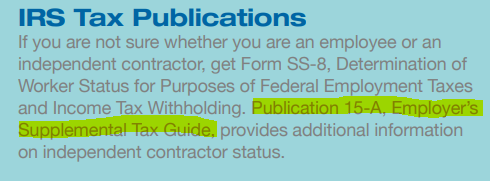

IRS Publication 15A, Employers Supplemental Tax Guide Details

Publications

Joel M. Cohn and Richard J. Rabin published article called ” Analyzing the Latest Risks of Worker Misclassification” on Monday, March 2012 in New York Law Journal. It showed the misclassification of 216(b). For example To identify the misclassification, New York established the Joint Enforcement Task Force on Employee Misclassification, creating a partnership between the NYSDOL, the New York State Workers’ Compensation Fraud Inspector General, the New York State Department of Taxation and Finance,the New York State Workers ‘ Compensation Fraud Inspector General, the New York State Attorney General’s Office, and the Controller of the City of New York” But the District Judge never follow it.

Worker Misclassification by Joel M. Cohn and Richard J. Rabin published on Monday, March 2012 in New York Law Journal …Details here

Identification of Employee or Independent Contractor? One judge said misclassification but other judge decided without collaboration with IRS and DOL.

IRS and DOL Published a guideline Identification of Employee or Independent Contractor?

Publication 15-A:Employer’s Supplemental Tax Guide, 2. Employee or Independent Contractor? and the form 15A details…

2. Employee or Independent Contractor? by IRS

An employer must generally withhold federal Income taxes, withhold and pay over social security and Medicare taxes, and pay unemployment tax on wages paid to an employee. An employer doesn’t generally have to with hold or pay over any federal taxes on payments to independent contractors.

Common-Law Rules

To determine whether an individual is an employee or an independent contractor under the common-law, the relationship of the worker and the business must be examined. In any employee-independent contractor determination, all information that provides evidence of the degree of control and the degree of independence must be considered

Facts that provide evidence of the degree of control and independence fall into three categories: behavioral control, financial control, and the type of relationship of the parties. These facts are discussed next.

Behavioral control. Facts that show whether the business has a right to direct and control how the worker does the task for which the worker is hired include the type and degree of:

Instructions that the business gives to the worker.

An employee is generally subject to the business’s instructions about when, where, and how to work. All of the following are examples of types of instructions about how to do work.

- When and where to do the work.

- What tools or equipment to use.

- What workers to hire or to assist with the work.

- Where to purchase supplies and services.

- What work must be performed by a specified individual?

- What order or sequence to follow.

The amount of instruction needed varies among different jobs. Even if no instructions are given, sufficient behavioral control may exist if the employer has the right to control how the work results are achieved. A business may lack the knowledge to instruct some highly specialized professionals; in other cases, the task may require little or no instruction. The key consideration is whether the business has retained the right to control the details of a worker’s performance or instead has given up that right.

Training that the business gives to the worker. An employee may be trained to perform services in a particular manner. Independent contractors ordinarily use their own methods.

Financial control. Facts that show whether the business has a right to control the business aspects of the worker’s job include:

The extent to which the worker has unreimbursed business expenses. Independent contractors are more likely to have unreimbursed expenses than are employees. Fixed ongoing costs that are incurred regardless of whether work is currently being performed are especially important. However, employees may also incur unreimbursed expenses in connection with the services that they perform for their employer.

The extent of the worker’s investment. An independent contractor often has a significant investment in the facilities or tools he or she uses in performing services for someone else. However, a significant investment isn’t necessary for independent contractor status.

The extent to which the worker makes his or her services available to the relevant market. An independent contractor is generally free to seek out business opportunities. Independent contractors often advertise, maintain a visible business location, and are available to work in the relevant market.

How the business pays the worker. An employee is generally guaranteed a regular wage amount for an hourly, weekly, or other period of time. This usually indicates that a worker is an employee, even when the wage or salary is supplemented by a commission. An independent contractor is often paid a flat fee or on a time and materials basis for the job. However, it is common in some professions, such as law, to pay independent contractors hourly

The extent to which the worker can realize a profit or loss. An independent contractor can make a profit or loss.

Type of relationship. Facts that show the parties’ type of relationship include:

- Written contracts describing the relationship the parties intended to create.

- Whether or not the business provides the worker with employee-type benefits, such as insurance, a pension plan, vacation pay, or sick pay.

- The permanency of the relationship. If you engage a worker with the expectation that the relationship will continue indefinitely, rather than for a specific project or period, this is generally considered evidence that your intent was to create an employer-employee relationship.

- The extent to which services performed by the worker are a key aspect of the regular business of the company. If a worker provides services that are a key aspect of your regular business activity, it is more likely that you’ll have the right to direct and control his or her activities. For example, if a law firm hires an attorney, it is likely that it will present the attorney’s work as its own and would have the right to control or direct that work. This would indicate an employer-employee relationship.

IRS help. If you want the IRS to determine whether or not a worker is an employee, file Form SS-8 with the IRS.

Industry Examples

The following examples may help you properly classify your workers.

Building and Construction Industry

Example 1. Jerry Jones has an agreement with Wilma White to supervise the remodeling of her house. She didn’t advance funds to help him carry on the work. She makes direct payments to the suppliers for all necessary materials. She carries liability and workers’ compensation insurance covering Jerry and others that he engaged to assist him. She pays them an hourly rate and exercises almost constant supervision over the work. Jerry isn’t free to transfer his assistants to other jobs. He may not work on other jobs while working for Wilma. He assumes no responsibility to complete the work and will incur no contractual liability if he fails to do so. He and his assistants perform personal services for hourly wages. Jerry Jones and his assistants are employees of Wilma White.

Example 2. Milton Manning, an experienced tile setter, orally agreed with a corporation to perform full-time services at construction sites. He uses his own tools and performs services in the order designated by the corporation and according to its specifications. The corporation supplies all materials, makes frequent inspections of his work, pays him on a piecework basis, and carries workers’ compensation insurance on him. He doesn’t have a place of business or hold himself out to perform similar services for others. Either party can end the services at any time. Milton Manning is an employee of the corporation.

Example 3. Wallace Black agreed with the Sawdust Co. to supply the construction labor for a group of houses. The company agreed to pay all construction costs. However, he supplies all the tools and equipment. He performs personal services as a carpenter and mechanic for an hourly wage. He also acts as superintendent and foreman and engages other individuals to assist him. The company has the right to select, approve, or discharge any helper. A company representative makes frequent inspections of the construction site. When a house is finished, Wallace is paid a certain percentage of its costs. He isn’t responsible for faults, defects of construction, or wasteful operation. At the end of each week, he presents the company with a statement of the amount that he has spent, including the payroll. The company gives him a check for that amount from which he pays the assistants, although he isn’t personally liable for their wages. Wallace Black and his assistants are employees of the Sawdust Co.

Example 4. Bill Plum contracted with Elm Corporation to complete the roofing on a housing complex. A signed contract established a flat amount for the services rendered by Bill Plum. Bill is a licensed roofer and carries workers’ compensation and liability insurance under the business name. Plum Roofing. He hires his own roofers who are treated as employees for federal employment tax purposes. If there is a problem with the roofing work, Plum Roofing is responsible for paying for any repairs. Bill Plum, doing business as Plum Roofing, is an independent contractor.

Example 5. Vera Elm, an electrician, submitted a job estimate to a housing complex for electrical work at $16 per hour for 400 hours. She is to receive $1,280 every 2 weeks for the next 10 weeks. This isn’t considered payment by the hour. Even if she works more or less than 400 hours to complete the work, Vera Elm will receive $6,400. She also performs additional electrical installations under contracts with other companies that she obtained through advertisements. Vera is an independent contractor.

Trucking Industry

Example. Rose Trucking contracts to deliver material for Forest, Inc., at $140 per ton. Rose Trucking Isn’t paid for any articles that aren’t delivered. At times, Jan Rose, who operates as Rose Trucking, may also lease another truck and engage a driver to complete the contract. All operating expenses, including insurance coverage, are paid by Jan Rose. All equipment is owned or rented by Jan and she is responsible for all maintenance. None of the drivers are provided by Forest, Inc. Jan Rose, operating as Rose Trucking, is an independent contractor.

Computer Industry

Example. Steve Smith, a computer programmer, is laid off when Megabyte, Inc., downsizes. Megabyte agrees to pay Steve a flat amount to complete a one-time project to create a certain product. It isn’t clear how long it will take to complete the project, and Steve isn’t guaranteed any minimum payment for the hours spent on the program. Megabyte provides Steve with no instructions beyond the specifications for the product itself. Steve and Megabyte have a written contract, which provides that Steve is considered to be an independent contractor, is required to pay federal and state taxes, and receives no benefits from Megabyte. Megabyte will file Form1099-NEC, Nonemployee Compensation, to report the amount paid to Steve. Steve works at home and isn’t expected or allowed to attend meetings of the software development group. Steve is an independent contractor.

Automobile Industry

Example 1. Donna Lee is a salesperson employed on a full-time basis by Bob Blue, an auto dealer. She works 6 days a week and is on duty in Bob’s showroom on certain assigned days and times. She appraises trade-ins, but her appraisals are subject to the sales manager’s approval. Lists of prospective customers belong to the dealer. She is required to develop leads and report results to the sales manager. Because of her experience, she requires only minimal assistance in closing and financing sales and in other phases of her work. She is paid a commission and is eligible for prizes and bonuses offered by Bob. Bob also pays the cost of health insurance and group-term life insurance for Donna. Donna is an employee of Bob Blue.

Example 2. Sam Sparks performs auto repair services in the repair department of an auto sales company. He works regular hours and is paid on a percentage basis. He has no investment in the repair department. The sales company supplies all facilities, repair parts, and supplies; issues instructions on the amounts to be charged, parts to be used, and the time for completion of each job; and checks all estimates and repair orders. Sam is an employee of the sales company.

Example 3. An auto sales agency furnishes space for Helen Bach to perform auto repair services. She provides her own tools, equipment, and supplies. She seeks out business from insurance adjusters and other individuals and does all of the body and paint work that comes to the agency. She hires and discharges her own helpers, determines her own and her helpers’ working hours, quotes prices for repair work, makes all necessary adjustments, assumes all losses from uncollectible accounts, and receives, as compensation for her services, a large percentage of the gross collections from the auto repair shop. Helen is an independent contractor and the helpers are her employees.

Attorney

Example. Donna Yuma is a sole practitioner who rents office space and pays for the following items: telephone, computer, on-line legal research linkup, fax machine, and photocopier. Donna buys office supplies and pays bar dues and membership dues for three other professional organizations. Donna has a part-time receptionist who also does the bookkeeping. She pays the receptionist, withholds and pays federal and state employment taxes, and files a Form W-2 each year. For the past 2 years. Donna has had only three clients, corporations with which there have been long-standing relationships. Donna charges the corporations an hourly rate for her services, sending monthly bills detailing the work performed for the prior month. The bills include charges for long distance calls, on-line research time, fax charges, photocopies, postage, and travel, costs for which the corporations have agreed to reimburse her. Donna is an independent contractor.

Taxicab Driver

Example. Tom Spruce rents a cab from Taft Cab Co. for $150 per day. He pays the costs of maintaining and operating the cab. Tom Spruce keeps all fares that he receives from customers. Although he receives the benefit of Taft’s two-way radio communication equipment, dispatcher, and advertising, these items benefit both Taft and Tom Spruce. Tom Spruce is an independent contractor.

Salesperson

To determine whether salespersons are employees under the usual common-law rules, you must evaluate each individual case. If a salesperson who works for you doesn’t meet the tests for a common-law employee, discussed earlier in this section, you don’t have to withhold federal income tax from his or her pay (see Statutory Employees in section 1). However, even if a salesperson isn’t an employee under the usual common-law rules for income tax withholding, his or her pay may still be subject to social security. Medicare, and FUTA taxes as a statutory employee.

To determine whether a salesperson is an employee for social security. Medicare, and FUTA tax purposes, the salesperson must meet all eight elements of the statutory employee test. A salesperson is a statutory employee for social security. Medicare, and FUTA tax purposes if he or she:

- Works full-time for one person or company except, possibly, for sideline sales activities on behalf of some other person;

- Sells on behalf of, and turns his or her orders over to, the person or company for which he or she works;

- Sells to wholesalers, retailers, contractors, or operators of hotels, restaurants, or similar establishments;

- Sells merchandise for resale, or supplies for use in the customer’s business;

- Agrees to do substantially all of this work personally;

- Has no substantial investment in the facilities used to do the work, other than in facilities for transportation;

- Maintains a continuing relationship with the person or company for which he or she works; and

- Isn’t an employee under common-law rules.

On October 11, 2022, the U.S. Department of Labor announced the publication of a proposed rule to revise the Department’s guidance on how to determine who is an employee or independent contractor under the Fair Labor Standards Act (FLSA). The Notice of Proposed Rulemaking (NPRM) would rescind an earlier rule on this topic that was published on January 7, 2021, and replace it with an analysis for determining employee or independent contractor status that is more consistent with the FLSA as interpreted by longstanding judicial precedent. The Department believes that its proposed rule would reduce the risk that employees are misclassified as independent contractors, while providing added certainty for businesses that engage (or wish to engage) with individuals who are in business for themselves.

The Department encourages interested parties to submit comments on this proposal by November 28, 2022. The full text of the NPRM, as well as information on the deadline for submitting comments and the procedures for submitting comments, can be found at Federalregister.gov. The NPRM’s 45-day comment period closes at 11:59 p.m. ET on November 28, 2022.

Anyone who submits a comment (including duplicate comments) should understand and expect that the comment, including any personal information provided, will become a matter of public record and will be posted without change to www.regulations.gov. The Wage and Hour Division posts comments gathered and submitted by a third-party organization as a group under a single document ID number on www.regulations.gov, including any personal information provided.

Additional Information

Proposed Rule: Employee or Independent Contractor Classification under the Fair Labor Standards Act

News Release: U.S. Department Of Labor Announces Proposed Rule on Classifying Employees, Independent Contractors; Seeks to Return to Longstanding Interpretation

Proposed Rule: Employee or Independent Contractor Classification under the Fair Labor Standards Act, An unpublished Proposed Rule by the Wage and Hour Division on 10/13/2022

More Cases:

- PATRICIA JO LEMASTER, TERRI JO LEMASTER, and PEGGY MCCOMAS, Plaintiffs ALTERNATIVE HEALTHCARE SOLUTIONS, INC. Link: LeMaster et al v. Alternative Healthcare Solutions

- JUDY CROUCH, et al., Plaintiffs GUARDIAN ANGEL NURSING INC. et al. Defendants. Link: Crouch et al v. Guardian Angel Nursing 2

- JUDY CROUCH, CHERYL HUFF, ERIC THREADGILL, REBECCA BLACKBURN, SHAUNA HENSLEY, PAT PLASKETT, PATTY MASON, ELONDA LAYNE, LISA JOHNSON, ANTHONY QUINN, JENNIFER FRALE, BRANDY ROHWEDER, SHERRY ABSTON, JOYCE BARNARD, VICKI BEATY, ZORA BOSWELL, MICHAEL CONATSER, SANDY CONATSER, SHELIA EMBERTON, JAMMIE GOFF, TAMMY LIPSCOMB, LARRY MCDONALD, REBECCA MILLER, LINDA NASH, NANCY NEXBITT, RICHARD PHILLIPS, MARY REAGAN, RICHARD REAGAN, GINA RODDY, LAKEISHA SANDERS, KAREN STAFFORD, MARTI STAFFORD, JANICE TRENT, MARY WALKER and FELISA WRIGHT on behalf of themselves and all others similarly situated. Link: Crouch et al v. Guardian Angel Nursing

TITLE 28 JUDICIARY AND JUDICIAL PROCEDURE

FEDERAL GOVERNMENT LIABILITY AND TORT CLAIMS